As any government knows, ‘…we have what it takes to take what you have…’

The Land Value Tax of 1692 was enacted with the intention of gaining income for the Crown through a tax related to the value of a property rather than the actual income of an individual. Initially, it was intended to run from year to year upon review, but by 1798 an amendment in the Act made the tax perpetual. The tax was based upon the value of the property: building, land, mine, field, shop or workshop, at the rate of 12d in the pound (5%) viewed against the market rental value. Although it was resented, the tax was able to raise some £2 million by 1798.

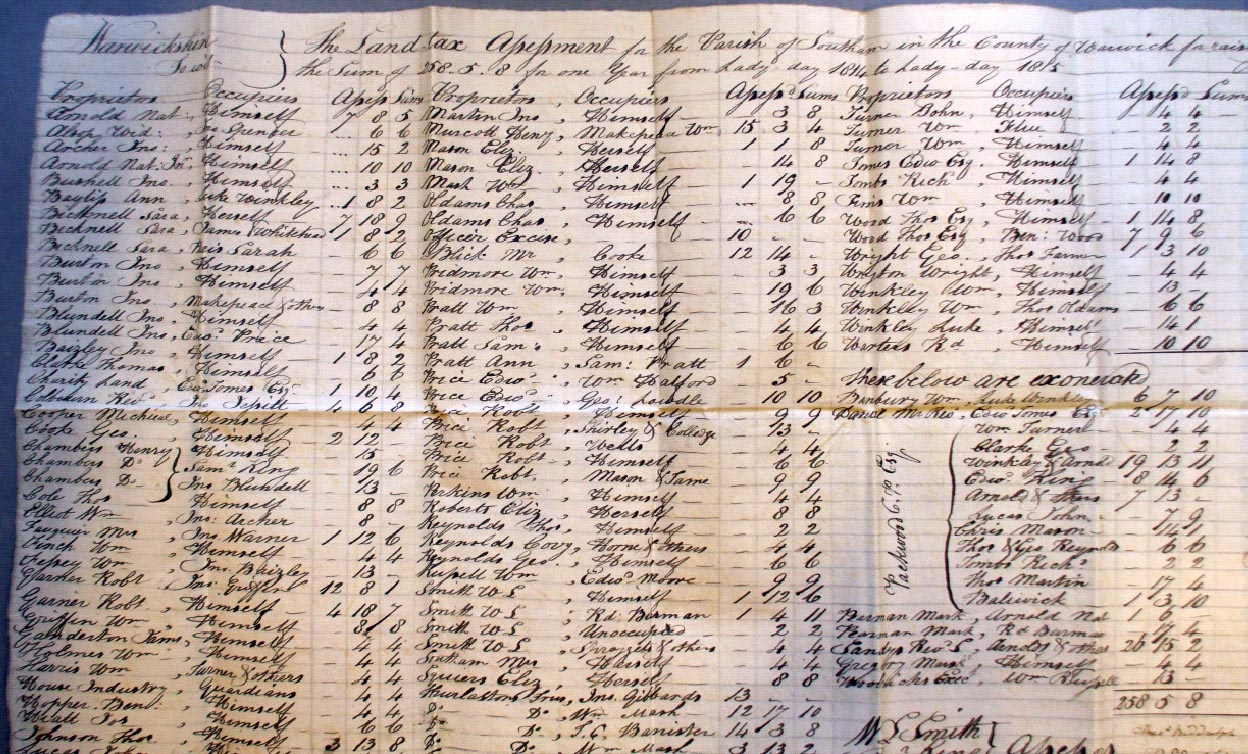

In 1798 a Land Tax Redemption Office was created whereby the liability could be redeemed by the payment of a lump sum, equivalent to fifteen years of contributions. Landowners who opted for this were thus ‘exonerated’ from the annual payment. In Southam, in 1802, Charles Porter Packwood was exonerated from the payment of some £38 6s 6d from his ten properties. However, he would have had to have available some £574 16s 3d to qualify. The Reverend William Daniel at £2 17s 6d was also exempted. However, the Reverend Samuel Sandys opted to pay the yearly tax of £26 15s 2d for his glebe land rentals. Lord Craven also opted to pay the annual charge of £68 8s 5d on his twelve rental properties.

Properties under the value of £20 were exempt from payment; hence not all landowners, tenants, labourers, or sub-tenants were included in official records of residence. In 1745 an Act specified that freeholders entitled to vote were only able to do so if they paid the tax.

As with many laws lacking Parliamentary scrutiny, there proved to be ambiguities. In this case, the tax could be based arbitrarily upon agricultural land (pasture or arable) and how a property was used. It was, in some cases, not clear which property was to be taxed, and the land itself could vary in terms of perceived quality and productivity.

In Southam, records of the Land Tax Assessments exist from 1776, thus providing evidence of the main property owners and tenants in the town. Although the landowners were liable to pay the tax, tenants could substitute for this and then gain a rebate against their annual rent.

In 1776 the total amount raised in Southam through the tax was £258 5s 8d, and this would be the fixed revenue sum exacted for many years. In that year the principal landowners where assessment was valued at over £5 included the Reverend Joseph Davie (Rector), Thomas Turner, William Murcott, John Nicholls, Lord Craven, John Tomes, John Newcombe, Charles Packwood and others.

By 1800, 106 properties were subject to the tax, with only 35 occupied by their owners. Between 1813 and 1825 it appears that the Craven properties had all passed into the hands of Charles Packwood (with his eleven tenants occupying). The governments had taken what they had!

Southam Heritage Collection is located in the atrium of Tithe Place opposite the Library entrance. Opening times Tuesday, Thursday, Friday and Saturday mornings from 10am to 12 noon. To find out more about Southam’s history, visit our website www.southamheritage.org telephone 01926 613503 or email southamheritage@hotmail.com You can also follow us on Facebook.

Leave A Comment